Demand boosted by temporary residents…

A surge of temporary residents is boosting demand for homes in supply-starved market

![]()

Matt Lundy, Economics Reporter

Globe & Mail February 17 2023

A record-setting influx of temporary residents is putting additional strain on the Canadian housing market, just as the construction industry is pulling back on new builds.

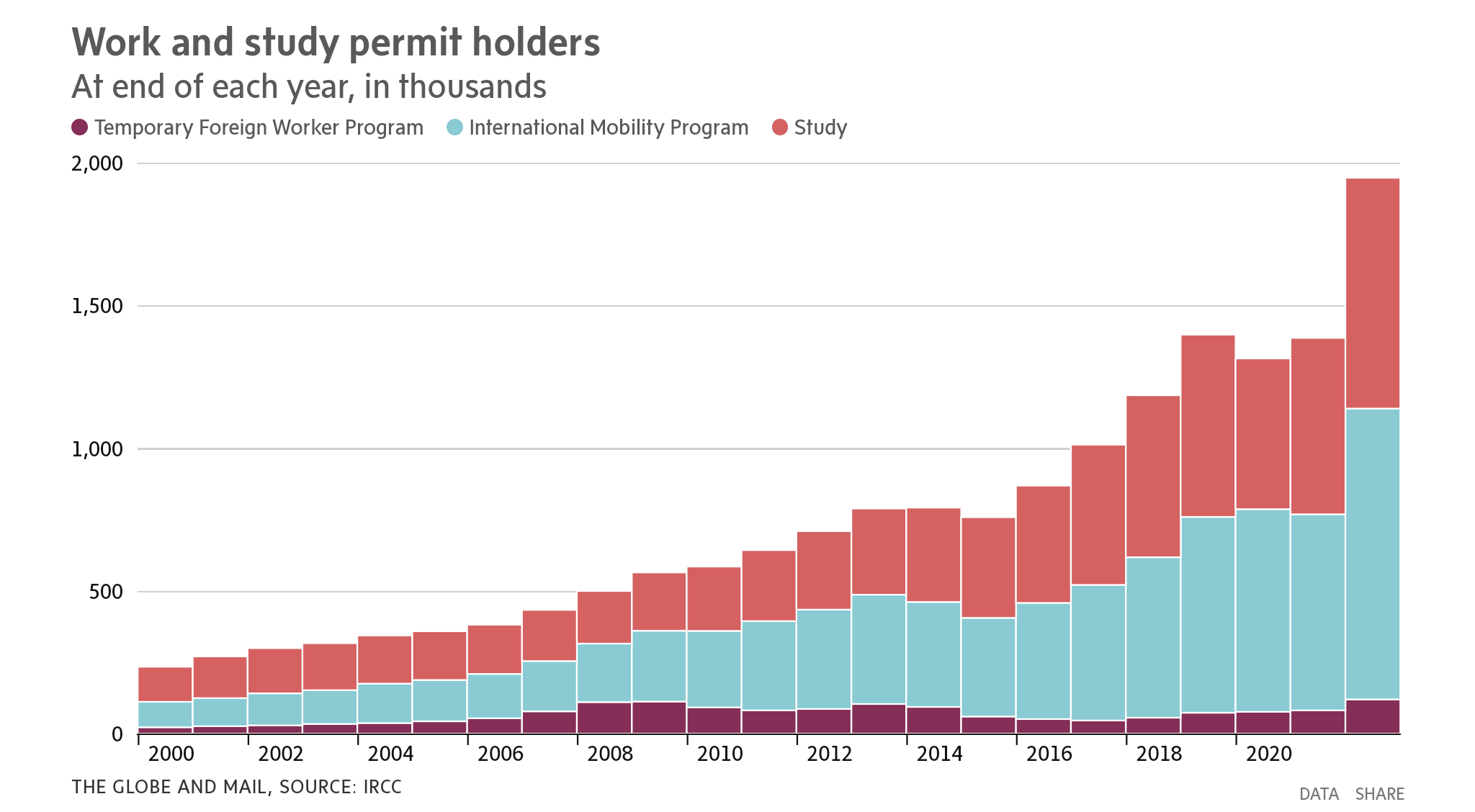

By the end of 2022 there were roughly 1.95 million people from abroad with temporary work or study permits in the country, an increase of about 560,000 (40 per cent) over the previous year, according to recently published figures from Immigration, Refugees and Citizenship Canada.

The International Mobility Program accounted for slightly more than one million of those permits – a new high, up more than 300,000 in a year. The program covers a broad group of people, including the spouses of skilled workers and company transfers from foreign offices.

There were slightly more than 800,000 study permit holders at the end of last year, also a record high. Another 120,000 people held permits under the Temporary Foreign Worker (TFW) Program, the most since at least 2000.

Canada is deliberately raising its intake of immigrants, with the goal of admitting 500,000 permanent residents annually by 2025. However, that reflects just a portion of newcomers to the country.

Based on the latest estimates, in the third quarter of 2022 Canada’s population grew at its quickest pace in more than 50 years, mostly because of the increase in temporary residents.

Their ranks grew by more than 225,000 during the three-month period, well above the previous record. Many of them aspire to stay in Canada permanently.

Experts say the country is increasingly moving to a two-step immigration process, in which people come for an education or work experience, then apply for permanent resident status.

In recent months, the federal government has been criticized for its immigration policies, particularly when the country is struggling to build enough homes and deliver basic medical services.

It has become “an unplanned, unmanaged, improvised immigration system,” said Anne Michèle Meggs, a former director of planning and accountability at Quebec’s Immigration Ministry. “Who is this helping?”

To some degree, special circumstances have contributed to the population surge. Canada has been admitting thousands of people fleeing Ukraine since the Russian invasion, and there has been a forceful rebound in the number of international students, many of whom delayed their studies here during the acute phases of the pandemic.

Still, the spike in temporary residents over the past year was “driven” by people with work permits, Statistics Canada said in its latest population report. The federal government is courting more foreign workers, broadening access to low-wage

workers through the TFW program and allowing foreign students to work longer hours – moves that it says are aimed at easing labour shortages.

Several economists have criticized Ottawa for flooding the market with cheap labour and suppressing wages.

Meanwhile, colleges and universities have dramatically increased the enrolment of foreign students, who pay significantly more in tuition than their domestic peers. There are no limits on this form of migration.

Many newcomers are discovering that homes in Canada are both pricey and in short supply. A report by Desjardins Securities published this week said residential home construction would need to immediately increase by 50 per cent through the end of 2024 in order to support higher immigration targets and keep prices from climbing further. It does not appear that will happen. Facing steep costs and higher interest rates, some developers are cancelling or delaying projects. Earlier this week, Canada Mortgage and Housing Corp. reported that housing starts fell 13 per cent in January from December, to an annualized pace of about 215,000 units.

In parts of Ontario with a population of 10,000 and higher, housing starts fell 31 per cent to an annual rate of roughly 71,500 units. That is well below the provincial government’s target of building 150,000 units a year for the next decade to alleviate the housing crisis.

“It certainly makes sense that building activity would be cooling amid a steep drop in sales and prices,” Bank of Montreal chief economist Doug Porter said in a note to clients, referencing the recent slump in real estate activity amid higher borrowing costs. “Notwithstanding the broad and wide calls for the need for massive increases in new home construction in Canada, the reality is that starts are dictated by the market, and not by pundits.”